How Hsmb Advisory Llc can Save You Time, Stress, and Money.

A possession has three necessary attributes: It personifies a probable future benefit that involves a capacity, singly or in combination with other properties, to contribute directly or indirectly to future internet money inflows; A specific entity can get the benefit and control others' access to it; and The purchase or other event-giving increase to the entity's right to or control of the benefit has currently occurred.

- A governmental pool developed to create business declined by providers in the conventional insurance policy market. - a policy or biker that gives coverage just while an insurance holder is restricted to a nursing home and fulfills the policy needs for protection. - the presumption of risk from one more insurance entity within a reinsurance contract or treaty.

- theoretical amount of resources plus surplus an insurance business should keep. - reinsurance placed with a reinsurer that is accredited or otherwise allowed to perform reinsurance within a state. - insurance coverage that shields versus financial loss due to the fact that of legal responsibility for motor automobile related injuries (bodily injury and medical settlements) or damage to the residential property of others triggered by accidents arising out of ownership, maintenance or use a car (consisting of mobile homes such as motor homes).

Hsmb Advisory Llc Can Be Fun For Anyone

No Mistake is specified by the state worried. - automobile insurance coverage (including collision, vandalism, fire and theft) that insures versus product damages to the insured's automobile. St Petersburg, FL Life Insurance. Commercial is specified as all automobile policies that consist of automobiles that are utilized in link with service, industrial establishments, activity, work, or tasks continued for gain or revenue

- accountancy statement showing the financial problem of a firm at a certain date. - classification system for assessment of building regulations per geographical area with special emphasis on reduction of losses from all-natural disasters. - a person that might come to be qualified to get payment as a result of will, life insurance coverage policy, retired life strategy, annuity, count on, or other agreement.

- protection for property and responsibility that includes even more than one location, course of residential property or employee. - covers damages to enjoyment boats, electric motors, trailers, boating equipment and individual watercraft along with physical injury and residential or commercial property damages obligation to others. - physical injury consisting of illness or disease to a person.

Hsmb Advisory Llc Can Be Fun For Anyone

Benefits include (i) home of the guaranteed, which has been directly harmed by the accident; (ii) expenses of short-term fixings and accelerating expenditures; and (iii) obligation for damage to the residential or commercial property of others. Insurance coverage additionally consists of evaluation of the equipment. - a type of debt protection whereby the financial obligation holder has a financial institution risk in the business.

- original price, consisting of capitalized acquisition prices and built up devaluation, unamortized premium and discount, deferred source and dedication fees, direct write-downs, and increase/decrease by modification. - a person who gets compensations from the sale and solution of insurance coverage. These people work with part of the consumer and are not limited to marketing plans for a details firm but payments are paid by the firm with which the sale was made.

Little Known Facts About Hsmb Advisory Llc.

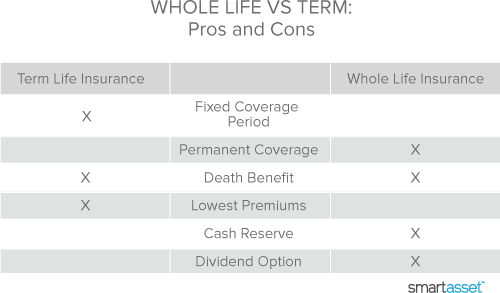

- loss of income as a result of building damages to a business facility. - company insurance policy usually for property, obligation and organization interruption protection. - in medical insurance, the amount that must be paid by the insured throughout a fiscal year prior to the insurance firm comes to be in charge of additional loss expenses.

- legal demand ordering business to keep their capital and excess at a quantity equal to or over of a specified amount to aid assure the solvency of the firm by providing a monetary cushion versus anticipated loss or mistakes and generally determined as a firm's admitted properties minus its obligations, established on a statutory audit basis.

Relied on the basis of initial cost readjusted, as suitable, for amassing of discount or amortization of costs and for depreciation (https://hsmb-advisory-llc.webflow.io/). - a payment strategy used about some handled care contracts where a doctor or various other medical company is paid a flat quantity, normally on a regular monthly basis, for each and every client who has actually elected to make use of that physician or medical provider

The capitated supplier is generally accountable, under the view website problems of the contract, for providing or scheduling the delivery of all acquired wellness solutions required by the covered individual. - a person that sells or services insurance policy contracts for a particular insurer or fleet of insurance companies. - an insurance provider established by a parent company for the objective of guaranteeing the parent's exposures.

5 Easy Facts About Hsmb Advisory Llc Described

- a legal tender. - short-term, extremely fluid investments that are both (a) readily convertible to well-known amounts of money, and (b) so near their maturation that they offer trivial threat of changes in worth since of changes in interest prices. Investments with initial maturities of three months or less certify under this meaning.